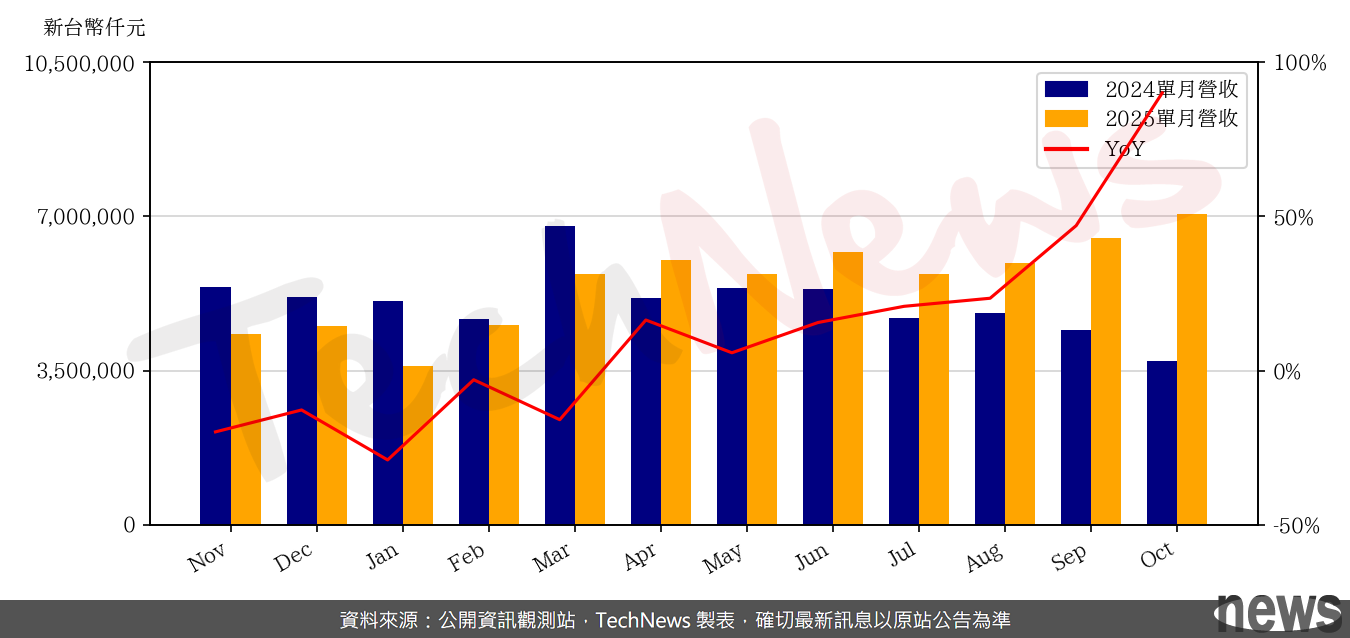

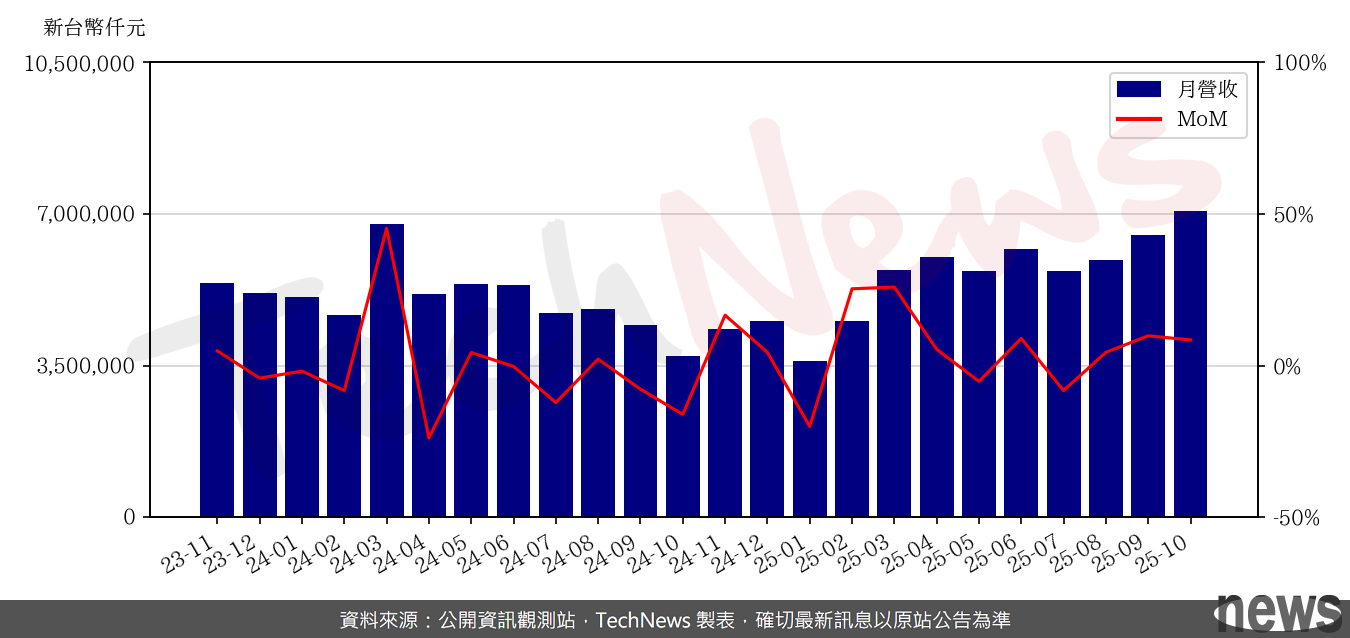

The stock price rose sharply in the second half of 2025. Phison, a major memory control IC design manufacturer, held a press conference on the 7th to announce its financial report for the third quarter of 2025. Revenue was NT$18.137 billion, an increase of 1.4% from the second quarter and an increase of 30.1% from the same period in 2024. The gross profit margin was 32.4%, an increase of 3.3 percentage points from the second quarter and an increase of 3.2 percentage points from the same period in 2024. Net profit after tax was 2.227 billion yuan, and EPS was 10.75 yuan, higher than 3.60 yuan in the second quarter. Cumulatively, in the first three quarters, it earned nearly 2 shares of capital, with EPS reaching 19.9 yuan.

Pan Jiancheng, CEO of Phison Electronics, said that the current NAND storage market supply continues to be tight. Driven by global AI and high-end computing demand, NAND original manufacturers are still conservative about capacity expansion. In addition, DRAM/HBM quotations remain high and some NAND production capacity is squeezed out, making the delivery time extension more obvious. In this environment, Phison continues to strengthen the market layout of mid-to-high-end NAND solutions, avoid low-price competition through product differentiation and technological innovation, and works closely with the supply chain and customers to ensure stable supply and meet the needs of the global market as much as possible.

Pan Jiancheng then emphasized that in terms of demand momentum, as CSPs continue to increase their introduction of enterprise-level SSDs, and Phison has successfully entered the supply chains of multiple international server systems, it will help the enterprise-level storage business continue to expand its revenue share. In the mobile device market, Phison's eMMC and UFS product lines have steadily expanded their market share, and the automotive UFS solution has also begun to gradually increase shipments, which is expected to have a positive contribution to revenue. In addition, PC OEM and Mobile customers have strong demand for NAND control chips, driving the company's related control chip ICs to maintain tight supply. Looking forward to the future, Phison will continue to deepen its technical strength and localized service advantages, seize high-growth demand, and steadily promote the company's long-term operating performance.

In addition, Phison also announced its consolidated revenue in October, which amounted to NT$7.065 billion, a growth rate of 8% compared with September and a growth rate of 90% compared with the same period in 2024. Among them, the annual growth rate of PCIe SSD control chip shipments in October reached 280%. The cumulative annual revenue through October was NT$56.931 billion, an increase of 14% from the same period in 2024, a new high for the same period in history.